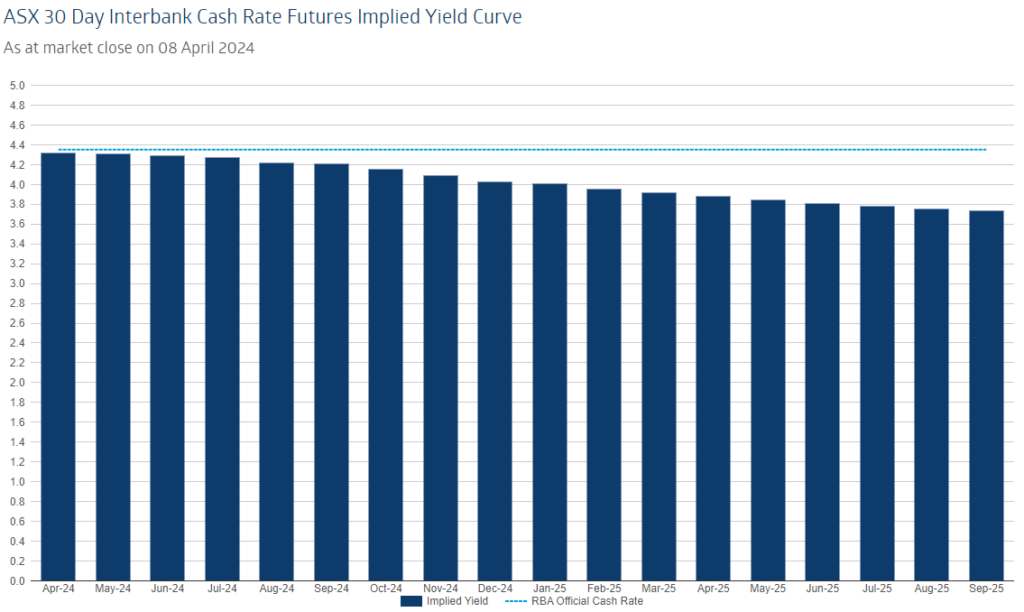

Cash Rate Expectations

- ANZ: 1 cut in Q4 2024

- CBA: 3 cuts late 2024

- NAB: 1 cut November 2024

- Westpac: 2 cuts late 2024

RBA Statement Summary – Key takeaways from their statement below:

- Cash rate steady at 4.35%

- Inflation is falling but still remains high, driven by goods inflation falling whiles services inflation remains elevated

- Labour market remains stronger than expected

- Household spending is low, reflecting the impact of higher rates

- Economic outlook remains uncertain

- RBA expects inflation to reach 2-3% only by 2025

- The priority remains returning inflation to target range = they will keep rates higher for longer and risk a recession

Inflation

- February Inflation (released 27 March) printed at 3.4% for the second month in a row

- The price of goods is falling but the price of services remain elevated.

- It’s likely inflation has peaked but the rate at which inflation falls remains uncertain

Unemployment

- Latest unemployment data released in March unexpectedly dropped to 3.7% vs market expectation of 4%

- This reflects a strong and resilient labour market and reduces the likelihood of a rate cut earlier than expected

- More jobs = stronger economy = stickier inflation = higher rates for longer

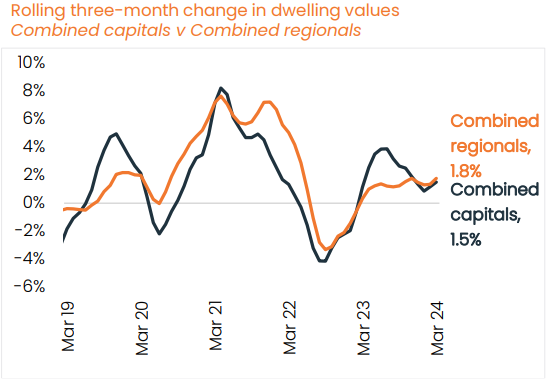

Property Market Update

- National home values index rose 0.6% in March, the 14th month of positive growth

- Adelaide and Perth posted the strongest results with 1.4% and 1.9%

- Volume of home sales through the Q1 24 are 9.5% higher relative to Q1 23

- The national rental index was up 2.8% in the March quarter, the fastest quarterly pace of rental growth since the three months ending May 2022 (2.9%)

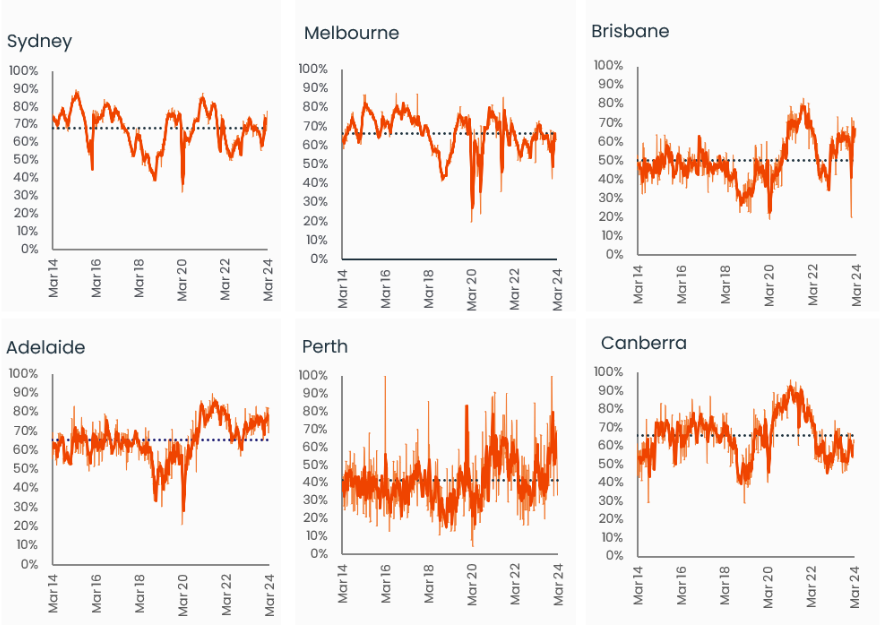

Capital City Clearance Rates

- Capital city clearance rates hold above 70% over Easter – over 65% is usually indicative of a rising market

- Sydney and Adelaide with the highest at 78%